Budgeting

Take control of your money with our budgeting advice.

About budgeting

A budget is simply a plan for your money: What you need to pay, when you need to pay it and how much you have left over to spend on fun stuff. Everyone should have some kind of budget, as it’s a key tool in managing your money.

Budgets for students

Budgets are especially important for students because students generally have less money than most people. When you don’t have much money, you need to be careful that what have is enough to keep up with financial responsibilities such as rent, bills, and food. If it’s your first time taking on such responsibilities, a budget will help you stay on track.

Making a budget

Knowing where to start with your budget might feel daunting. Remember the Student Finance Advisers at the University can meet with you one-to-one in person, or remotely via Zoom, to help you make a budget.

If you want to give things a go yourself first, Sorted have an excellent budgeting tool.

Budgeting tips

- Budget to your income frequency, not your bill frequency. It’s easier to put aside $20 per week for an $80 monthly power bill than to take $80 out of your income one week.

- Be realistic. If you know your groceries will cost $100 per week, don’t budget $50. This will just throw off your budget.

- Budgets need to breathe. Even if your income is limited, it’s important to budget for things that you value or enjoy.

If you want a more in-depth understanding of budgets, but don’t feel like you need to meet with a Student Finance Adviser, you can read more about them on the Sorted webpage.

If you have a surplus budget once all your financial responsibilities are covered, you may be able to regularly put money towards your savings. Saving for a goal is a good place to start. Work out how much in total you need to save to afford something you want, then calculate how long it will take based on how much spare money you have each week. Sorted have a great savings tool.

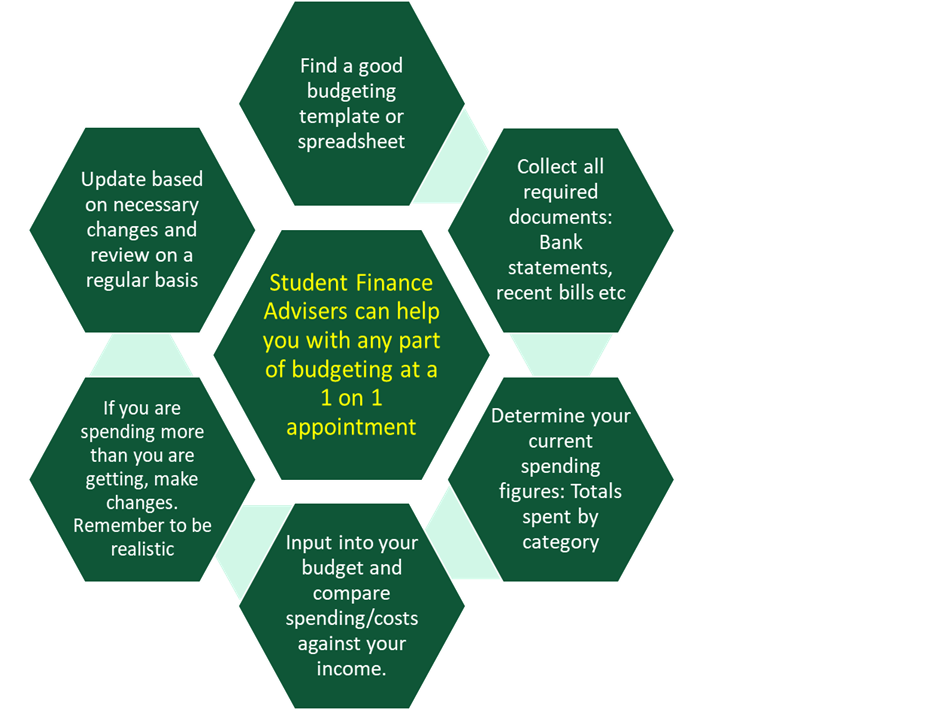

Step-by-step instructions for making a budget

- Get yourself a template or spreadsheet; we have some you can use.

- Collect your financial documents, such as: Last month’s transactions from your spending account, recent power bills, weekly grocery shopping receipts, anything that shows how you have been spending your money over the last few weeks.

- Use this information to figure out what your current spending is, in whatever way works best for you. For example, print your bank statement and highlight each transaction according to category, e.g. pink for food, yellow for entertainment, green for transportation, etc.

- Input these figures into your template or spreadsheet and use it to compare how much you’re spending with how much money you’re getting. The difference is your balance.

- If you don’t have money left over each week, decide where you will make changes to your spending. Reducing how much you spend on takeaways and fast food is often a good place to start. Be realistic; if you know you will spend money on something every week, include it in your budget. If you have money left over each week you don’t need to make changes, but you could still choose to.

- Update your spending figures to reflect any changes, then check how that affects your weekly balance. Your goal is to have money left over, or at least balance out to zero, at the end of each week.

The completed template or spreadsheet you end up with is your budget! If you stick to the spending figures on your budget, or keep track of overspending in one category and compensate by spending less in another, you can feel confident that you’ll have enough money to meet your financial responsibilities.

If you need help with any of these steps or want someone experienced to look over your budget, the Student Finance Advisers at Te Herenga Waka can help. Book an appointment here.

Reviewing your budget

Don’t just forget about your budget once it starts working. Make sure to review it regularly. A good general rule is that any time your financial situation changes (for better or worse) you should review your budget. A change to your financial situation could be any of the following: Rent increase or decrease, pay rise, drop in income, flatmates moving in or out, public transport cost changes, etc.

Blackbullion

Victoria University of Wellington has partnered with Blackbullion, an online financial literacy platform to provide our students with free access to a range of financial learning modules, resources and tools. Learn how to register for Blackbullion.